How much should you offer on the home you fell in love with?

by Kalen Isas

You’ve spent the last few months looking for a home and now the only thing that stands between you and having the right to negotiate full ownership of the home you fell in love with is preparing an offer that will be acceptable to the seller.

The purchase and sales agreement is the first formal communication that leads to the final deal and eventually a closing when it’s time for you to take ownership of the property.

The total agreement between buyer and seller combines financial details with overall efforts of both parties geared towards reaching an agreement and working on the steps towards the closing itself.

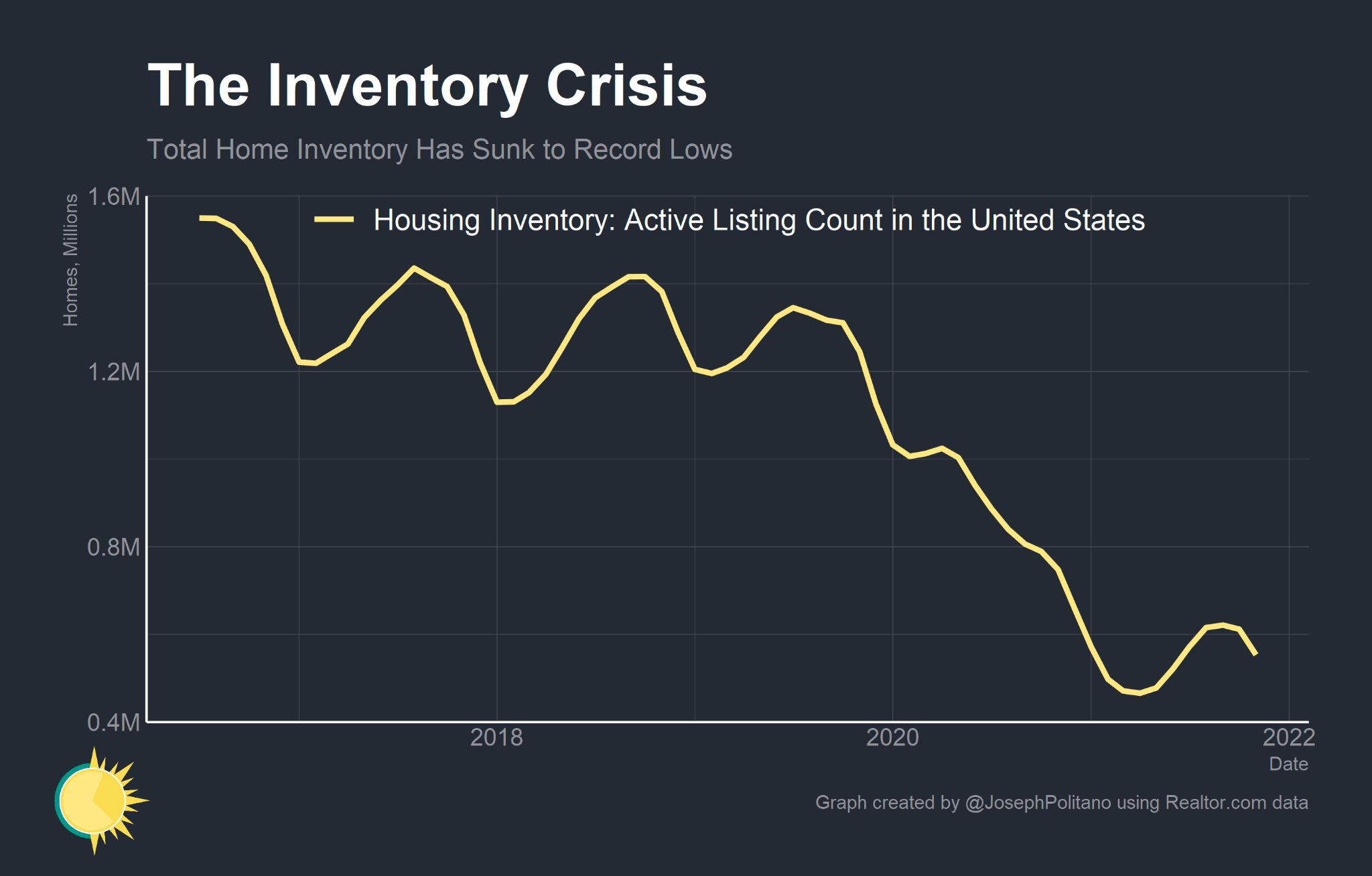

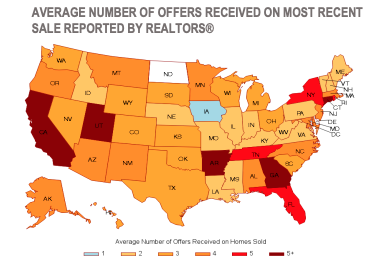

Over the last five-plus years, it’s been a seller’s market, which means that in general, homebuyers were at a bit of a disadvantage as they competed with other buyers for a limited supply of homes that got snapped up quickly from the market. The graphic shown below shows about a 44% increase in offers on listings compared to 2018.

In light of how things are happening at breakneck speed, putting together an offer that will be acceptable to a seller is not just about the price that will make the seller say yes, but also about squeezing out other potential buyers as well.

You want your offer to the seller to be as easy as possible to review, negotiate and accept. Specifically, the price, terms and conditions should make sense and be as acceptable as possible on your initial offer.

To help you put together an offer on the home that you fell in love with and understand what the seller is thinking and has to do, we’ve identified the steps you need to follow in making an offer on the home that you love.

Putting an Offer on a House

Making an offer on a house isn’t just about telling the seller how much you’re willing to pay. You must prove to the seller that you can afford the amount you’re offering, determine a closing date that works for the seller and you, explain how you’ll handle the closing costs on your end (or ask them to pay closing costs) and lastly, what you want the seller to do, if anything, leading up to closing.

In submitting an offer, you’ll want to put down earnest money to show the seller that you’re serious about buying the home.

The more money you put down, the more peace of mind the seller will have when it comes to your offer. That dollar amount can range from $500 to 10% (or more) of the agreed-upon price.

All of that said, the first thing you need to do is find a home you love and make sure it’s within your budget. Having a great agent — and a top-notch lender — to help you with that is probably going to be the best way to make that happen.

From there, here’s what you need to know.

When to submit your offer

Time kills deals. What that means is if you find a home that you love and it makes sense financially, then you need to move quickly to put in an offer on the home.

This holds especially true when you’re in a hot market where inventory is low and homes sell quickly, but it still makes good sense even when competing offers aren’t as likely so you don’t miss out on the home you fell in love with.

If you’re in a lease or have another home to sell, you’ll want to make sure that your obligation with your current dwelling is handled properly, i.e., notice is given to your current landlord or you have your home listed and under contract with a qualified buyer.

Doing this allows you to not only move forward with confidence, but it also makes it easier for the seller of the home you want to buy to feel more comfortable with your offer.

The fewer strings that are attached with your offer, the better your offer looks to the seller with whom you’re looking to negotiate.

How much to offer

There’s a lot of work that needs to go into putting the proper price on your offer to buy a home. In all likelihood, the seller has met with a real estate agent who provided a significant amount of detail as to why the home is priced the way it is.

When you’re ready to make an offer, your real estate agent will be able to sit with you and review the sales history of comparable properties in the area to help determine the home's approximate value versus what else has sold in the market.

In addition to recent sales and current buyer activity, you need to factor in your personal needs as well. Take a closer look at what the home does for you and consider the amount of work for upkeep, and money you’ll need to invest, in order to enjoy living in your home.

To do this, you’ll want to take into consideration things like:

-

Proximity to work, schools, stores, etc.

-

Neighborhood amenities

-

Age of major systems and appliances, including the HVAC, roof, plumbing and electric

-

Deferred maintenance

-

Renovations that need to be done

Once you’ve done your due diligence, you can then determine an appropriate dollar amount to offer. Consider these strategies as you craft your offer

-

If you’re the only one making an offer on the home and the listing is fairly new, you should definitely make an offer within 2% to 5% of the asking price. Letting the home stay on the market too long, where others can come snap it up, just leaves too much to chance.

The only caveat to this advice is if you’re buying in a market like we’re in now, where inventory is low and homes are selling fairly quickly. In this instance, your best bet is to put your best foot forward and offer full price as long as the home is priced properly.

-

If you’re the only one making an offer on the home and the listing is older, you can start your negotiations by offering at least 5% less than the asking price. Again, time kills deals and you have to realize that the longer you let the home stay on the market, the higher the chance that another offer can come in put you in a competitive situation, requiring you to pay more for the home.

-

If you’re in a competitive situation from the start, you at least have to put in a full-price offer with minimal contingencies or requirements of the seller. There’s a very good possibility that you may even have to pay over asking price in a competitive situation just to give yourself the best chance to secure the home for yourself. Your agent will advise you of what the best strategy is in situations like this.

Remember, the offer is not just about the price you’re willing to pay. It’s also about ancillary aspects of the offer like financing, contingencies, closing date, etc. Be sure to consult with your real estate agent to put together the absolute best offer you can.

Putting an offer together on a home can be exciting and scary all at the same time. The key is to remove emotions from the process as much as you can so you submit an offer that makes sense to you and the seller in the process.

Be sure to work with an agent who knows what they’re doing and can help you create an offer that has a high likelihood of getting accepted.

Recent Posts

- 10 questions you must ask an agent before you list your home

- How to beat other buyers to hot, new listings (Before they even know about them)

- When is the Best Season of the Year to Buy to get the Best Deal

- How much you should put down to purchase your new home?

- Why You Should Get a Home Warranty When You List Your Home