How to get qualified to purchase a home for no money down

by Kalen Isas

How to get qualified to purchase a home for no money down

Even with all the insanity that happened during the mortgage meltdown and all the changes that resulted in how money would now be lent to buyers, there are still some amazingly affordable loan programs out there.

Included, believe it or not, no-money-down options for buying a home.

Here are some of the best programs that are out there today and how you need to get qualified to purchase a home using them to buy a home for no money down.

USDA Loans

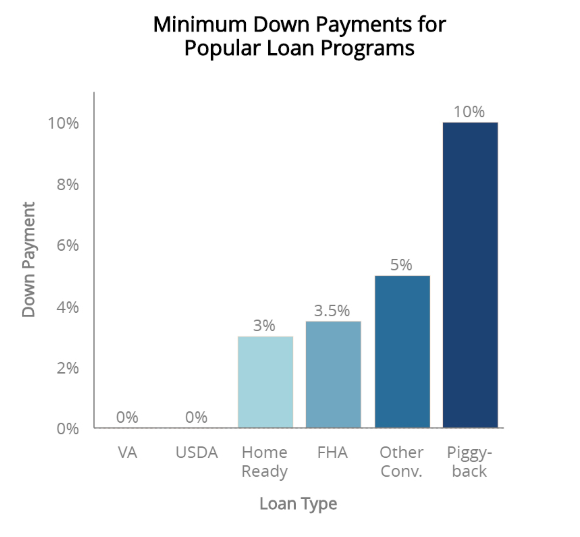

In 1990, the U.S. Department of Agriculture (USDA) created a housing program to help rural development. The USDA rural development loan is a zero-down mortgage for low-to-moderate income families.

In addition to getting into this type of loan for no money down, you can also benefit from the fact that the Mortgage Insurance Premium (MIP) is much lower than any other type of mortgage available. MIP is an insurance policy used by the lender to recoup their money in the event that the borrower defaults on their loan.

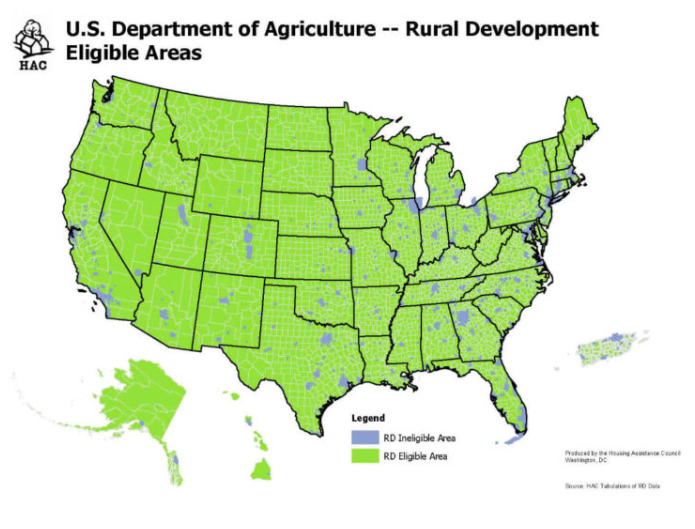

When most folks think of rural areas, they think farms and undeveloped land. However, the USDA eligibility map illustrates that most areas outside of the major cities are considered a rural area.

Based upon your income and desired location to live, a USDA Loan might just be the no-down-payment solution for you.

VA Loans

Simply put, if you’re a Veteran, you have a great shot of qualifying for a Veterans Administration (VA) mortgage. VA loans offer 100% financing so you need no money down. And, since the VA does not require mortgage insurance, borrowers save thousands of dollars a year on what they pay for their loan.

In recent years, VA loans have not been a favorite of sellers and their listing agents due to some of the more stringent requirements with home inspections. Lately, however, VA loans have come back into favor and are a great way to buy a home if you qualify as a current or retired member of our military.

Bar none, these loans are the cheapest mortgages available today. There are other fees included with these mortgages. One is the VA funding fee. Because VA home loans don’t require mortgage insurance, the VA charges a one-time funding fee to help the program stand on its own.

The fee is 2.15% of the loan amount. On a $250,000 mortgage, the funding fee will be $5,375 and the best part is that and can be financed into the loan.

In general, the credit requirements for VA loans will depend on which lender you use. Most lenders require a 620 credit score, but lower VA minimum credit requirements can be found with smaller lenders. You’ll want to review the Department of Veterans Affairs website to get more information and secure your VA certificate of eligibility, which is required of all veterans seeking a VA loan.

Navy Federal Credit Union

Here’s a neat program that many folks don’t know about. You can secure 100% financing If you’re a member of the Navy Federal Credit Union and are a first time home buyer. Here are the membership requirements according to the site:

- Active Duty members, reservists, veterans, retirees and annuitants of the Army, Marine Corps, Navy, Air Force and Coast Guard

- Army and Air National Guard personnel

- Delayed Entry Program personnel

- Department of Defense (DoD) civilians

- U.S. Government employees assigned to DoD installations

- Contractors assigned to DoD installations

- Family members of one of the above

If you fall into one of these categories, you may qualify for a no down payment home loan and no MIP.

FHA Loans

The Federal Housing Administration (FHA) was created in 1934 to encourage homeownership by reducing the requirements to get a mortgage loan. As a rule, this government-backed mortgage loan has a lot more flexible qualifying requirements than conventional loans, making it a huge choice among first-time buyers.

The FHA insures these loans, so if the borrower defaults on the loan the FHA pays the lender the amount owed on the home. As well, FHA loans come with multiple mortgage terms to choose from, with 30-year and 15-year fixed-rate mortgage loans being the most popular.

Normally, a down payment of 3.5% of the purchase price is required; however, you can use gift funds for the down payment. To put zero down, FHA gives you the opportunity to use gift funds for 100% of the down payment amount. For these funds, you can have a friend, relative, or company gift you the money for the one-time down payment, giving you the option to buy the home with no money down.

Down Payment Assistance Programs

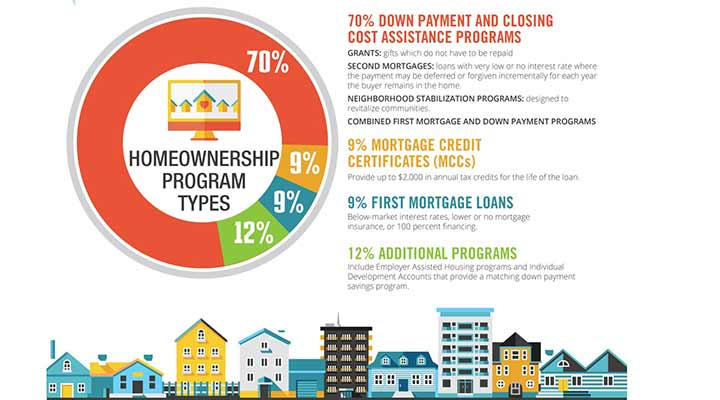

Although a lot of home buyers aren’t aware of them, there are many down payment assistance grants and programs out there to help potential home buyers with the issue of lack of down payment.

These down payment assistance programs are in abundance - over 2,300 of them - and they cover the wide variety of different types of home buyers in the market today.

Specifically, you don’t have to be a low-income buyer and/or household to qualify for many of these programs. In fact, in some areas of the country you can earn considerably more than your area’s median income and still be eligible for down payment assistance. In certain cases, high-income earners can qualify for a grant of up to 5% of the purchase price of the home!

On average, buyers can get assistance anywhere from $5,000 to $20,000, depending on the city, county, or state in which you live. In some areas where incomes and housing costs are higher, the down payment assistance can be as much as $100,000.

Many of these down payment assistance programs are set up as a silent, interest-free, second mortgage that only gets repaid when the home is sold or the mortgage is paid-off.

No matter which program you seek, lenders want you to have good credit and be able to document your income completely. They’re doing this because even though you might get some down payment assistance, they want to make sure that you have the ability to repay the loan.

The great news is this: If the home you’re looking to purchase qualifies for down payment assistance and your lender is signed up to participate in the program in which you’re interested, they will handle the paperwork to help you get the assistance.

There are more options than ever available to home buyers looking to buy a home with little to no money down.

Take the time to do your research and find out which program works best for you. Let us know if we can help.

Recent Posts

- 10 questions you must ask an agent before you list your home

- How to beat other buyers to hot, new listings (Before they even know about them)

- When is the Best Season of the Year to Buy to get the Best Deal

- How much you should put down to purchase your new home?

- Why You Should Get a Home Warranty When You List Your Home